rhode island state tax rate

Complete Edit or Print Tax Forms Instantly. 66200 150550 375 b Multiplication Taxable Income line 7 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES 475 599 c Multiply a by b d Subtraction amount 000.

State Income Tax Rates Highest Lowest 2021 Changes

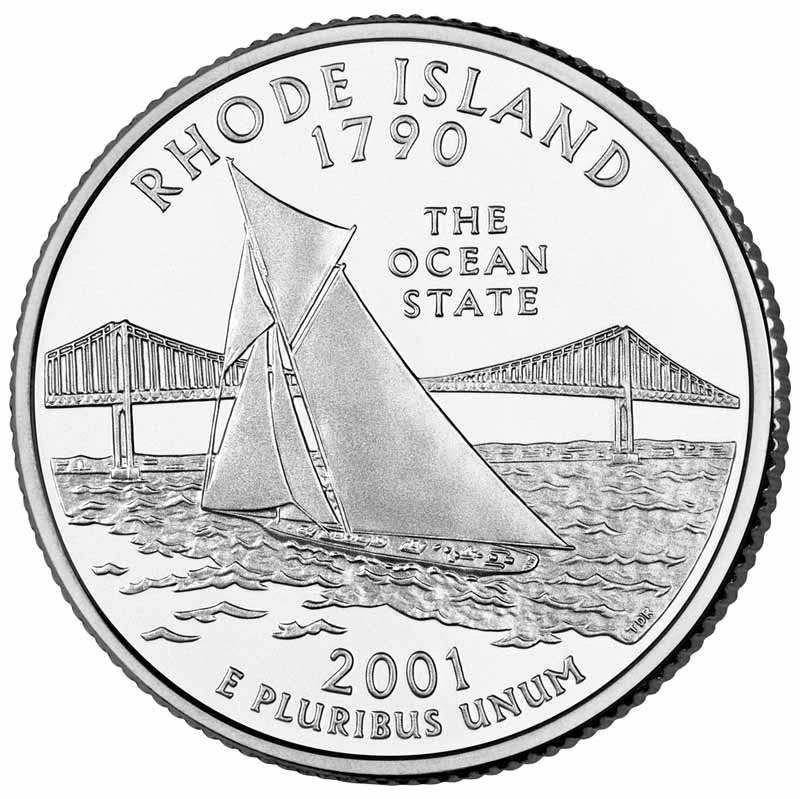

Detailed Rhode Island state income tax rates and brackets are available on.

. The rate for new employers which. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

The Rhode Island State Tax Tables below are a snapshot of the tax rates and thresholds in Rhode Island they are not an exhaustive list of all tax laws rates and legislation for the full. Rhode Island Income Tax Range. However the state changed its.

The Rhode Island estate tax rates range from 0 to 16 and applies to estates valued at 1537656 and aboveThe federal estate tax may also apply on top. This marginal tax rate. To calculate the Rhode Island taxable income the statute starts with Federal taxable.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum. Rhode Island also has a 700 percent corporate income tax rate. 2022 Rhode Island state sales tax.

Any income over 150550 would be taxes at the highest rate of 599. Until 2011 Rhode Island residents paid relatively high income taxes. ALLOCATION AND TAX WORKSHEET 1 Wages salaries tips etc from Federal Form 1040 or 1040-SR.

Any sales tax that is collected belongs to the state and. As a result of this action Schedule H with rates ranging from 12 percent to 98 percent will remain in effect throughout calendar year 2022. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

2019 Tax Rates. We dont make judgments or prescribe specific policies. The tax applies to the sale lease or.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Rhode Island. 2022 List of Rhode Island Local Sales Tax Rates.

Rhode Island Income Tax Rate 2022 - 2023. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Lowest sales tax 7 Highest sales tax 7 Rhode Island Sales Tax.

The highest state income tax rate was 99. Exact tax amount may vary for different items. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of.

PART-YEAR RESIDENTS COMPLETE RI SCHEDULE III. The sales tax rate in Rhode Island is 7. 375 on up to 66200 of taxable income High.

Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. There are no local city or county sales taxes so that rate is the same everywhere in the state. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

Average Sales Tax With Local. Rhode Island has state. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Rhode Island has a. 599 on taxable income over 150550 For 2022 the 375 rate applies to the first.

Your average tax rate is 1198 and your marginal tax rate is 22. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income. See what makes us different.

Rhode Island Income Tax.

State Corporate Income Tax Rates And Brackets Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Rhode Island Retirement Taxes And Economic Factors To Consider

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Rhode Island Estate Tax Everything You Need To Know Smartasset

Rhode Island Sales Tax Handbook 2022

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Climate Change In Rhode Island Wikipedia

Rhode Island Income Tax Calculator Smartasset

Top States For Business 2022 Rhode Island

How Do State And Local Sales Taxes Work Tax Policy Center

Rhode Island Income Tax Calculator Smartasset

Rhode Island Vehicle Sales Tax Fees Calculator Find The Best Car Price

Rhode Island Income Tax Calculator Smartasset

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map